Earlier this year, Portland, OR, residents Rick and Jackie White were stunned to find a very technically worded legal notice in their mail. A lien service company was informing them that a local towing company was auctioning off their 1970 ’Cuda to satisfy its unpaid storage bill.

They weren’t stunned because of the substantial unpaid bill. They were stunned because the Hemi ’Cuda had been stolen in 2001, and they had given up on ever finding it.

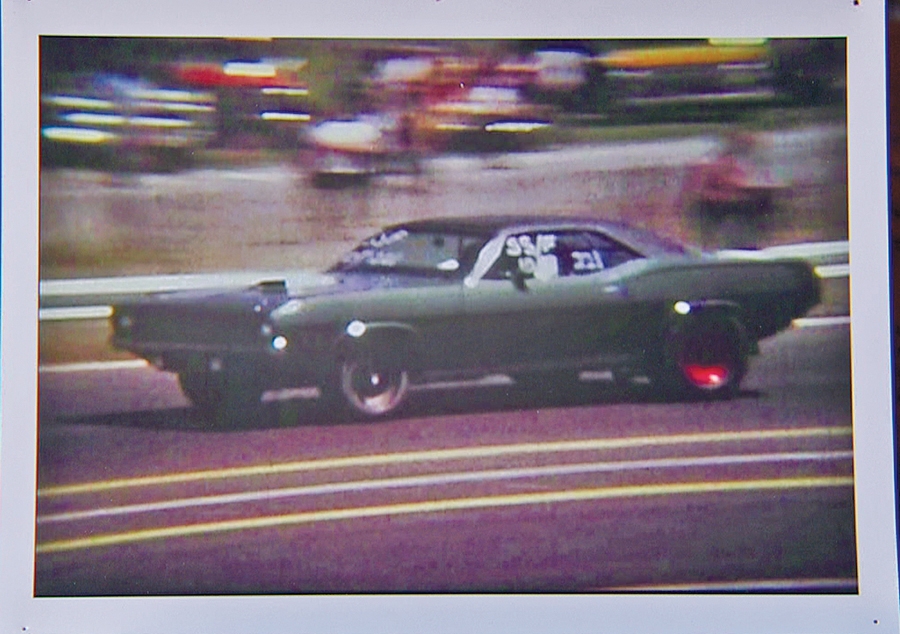

Rick White ordered the ’Cuda new in 1970 when he lived in California. It had a 440 Six Pack, 4-speed, 4.10 Dana rear end, bigger brakes — he ordered every option that would make it go fast. And it was a good looker — with dark metallic green paint with a silver shaker hood, black vinyl top and green interior.

After the thieves broke into his garage and rolled the ’Cuda away in 2001, all he had left to remember the all-original, numbers-matching car were some videos of the car racing on the Portland International Raceway drag strip. Now he was excited about getting it back.

They had contacted a towing

service to pay the storage bill and get the car back. He was surprised to learn that the man who had stored the car, Lee Sitton, had just paid the bill and taken the car back. So he contacted Sitton, who claimed that he had purchased the car from someone else. It was his and he wasn’t giving it back.

White smelled a rat. He had the title, but Sitton claimed he bought the car fair and square from a third party but never received a title.

“No one buys a car without getting a title,” White insists. He also thinks that the lien foreclosure was a ruse to get Sitton a title for the car.

Lien foreclosures

Under the law, a storage company has a lien against the car for unpaid storage charges. The procedure varies from state to state, but typically the car must be held for a minimum period of time after which the lien can be foreclosed. To do that, the storage company must serve legal notice on the registered owner with a statement of charges, which can now include various service and attorney fees; that is why the Whites received the notice.

If the unpaid fees are not cleared within the legally specified time, the storage company can auction off the car to the highest bidder, which often is the storage company itself. The process generates legal paperwork which confirms that the buyer acquired the car in the foreclosure sale, which the buyer can then use to obtain a new title. There is no need to get a transfer of the original title from the original owner, as he can’t be expected to cooperate.

Statute of limitations

So White went to the Portland Police Bureau to get his car back. Next big surprise: The police officer told him that, although he had properly reported the car stolen in 2001, the police could not get it back. The statute of limitations on the theft had run long ago, so they no longer had the legal authority to retrieve the car.

Sorry about that.

That didn’t make sense to White (it doesn’t make any sense to “Legal Files” either), so he kept pushing. A retired construction contractor, he couldn’t afford legal help, so he and Jackie started doing their own legal research on Google. They also kept going up the chain of command — to the county sheriff, then the Oregon State Police, and then the FBI. Everyone was very helpful, and the police and sheriff put in a lot of extra time to help.

Eventually, the Whites came up with a new plan. They just went down to the Portland Police station and filed a new stolen car report. That made the Portland Police happy and gave them the authority they needed (“Legal Files” doesn’t have any idea why a new stolen car report made the difference, but hey, it worked!). The police promptly went to Sitton’s gated estate with a warrant and tow truck and took the ’Cuda to impound.

The hardest part

As hard as that was to accomplish, getting the car back now seems to be the easy part. Sitton had dismantled the car and engine, so it went to impound in pieces. Sitton claims he did that to restore it. White claims he did that out of spite — he claims Sitton didn’t start to dismantle the ’Cuda until after White showed up on the scene.

White has inspected the car and parts several times. He told “Legal Files” that he noted various missing parts, which Sitton subsequently delivered to police impound after having said he had already provided everything. White thinks he has the original engine, transmission, body tags, etc., but he isn’t sure if the shaker is there. He has hired a Mopar expert to assist him in inventorying everything held at impound and determining what may still be missing. He has also retained legal counsel who is working on White’s claims against Sitton.

The story struck a nerve with the Problem Solvers department of Portland-based TV station KATU. They did a lot of investigative work and reported several times on their website and news broadcasts.

Those stories have led to other stories on other sites, and the Whites have attracted international attention. The Whites are amazed to have received contacts from people all over the world expressing sympathy for their situation. Many people have offered to send money for the re-assembly fund — and even to come and help with the work itself.

The Whites are touched by the generosity of strangers, and are thankful for the support. They are also hopeful that they will be able to find the money needed to get the ’Cuda back into its proper condition, as it has been a big part of their lives and they think it deserves to be restored. They just think that Sitton should be the one to pay for it.

Drowned Bugatti

“Legal Files” previously reported on the 2009 “drowning” of a Bugatti Veyron (February 2012, p. 36). The story summary is that Texan Andy House purchased the used 2006 Veyron for $1 million from a friend who agreed House could pay for the car later. House promptly insured the Veyron with Philadelphia Indemnity Insurance Company for $2.2 million, putting the first $22,000 annual premium on his credit card.

Five weeks later, House was driving the Veyron along the Texas Gulf Coast near Galveston when he suddenly turned and drove into the bay. He escaped from the car but left the engine running while it sat in a couple of feet of salt water. The engine eventually destroyed itself after reportedly gurgling like an outboard motor for about 15 minutes.

What made the story so amazing was that the entire episode was caught on a cell phone camera by two guys who were driving alongside the Bugatti on a parallel road. They were amazed to see the Bugatti and were filming it when, to their astonishment, it drove straight into the lagoon.

House explained that he had dropped his cell phone and, after picking it up, noticed that he was about to hit a low-flying pelican. He instinctively turned to avoid the bird, ending up in the drink. The insurance company claimed that he did all of this deliberately to cheat it out of the $1.2 million excess coverage. They were buoyed by the lack of any sign of a pelican on the cell phone video.

The story is now back in the news because House has pleaded guilty to wire fraud — acknowledging that the government was going to be able to prove that he intentionally destroyed the Veyron in order to defraud the insurance company out of the $1.2 million of excess coverage. His guilty plea has been accepted, but he still faces sentencing. Under the law, he faces a maximum of up to 20 years in prison, up to a $250,000 fine, or both.

Matt Hardigree reported on Jalopnik.com that House is the owner of Performance Auto Sales, which resells repaired exotic cars. Another one of House’s cars is the Ferrari Enzo that was crashed by actor Eddie Griffin.

Asked by Hardigree about the Veyron shortly after the incident, House replied, “Not sure if the car is salvageable yet, have not had a chance to go survey the damage. I am one of the largest salvage exotic dealers in the world. This car should be repairable but at what cost, I’m not familiar with. This was a personal car and one that I was very proud of. It is by far the nicest car that I have ever owned, looking to replace it now!”

Reports are that he did replace it with a 2008 Veyron in January 2010. No word on the current inventory. ♦

John Draneas is an attorney in Oregon. His comments are general in nature and are not intended to substitute for consultation with an attorney. He can be reached through www.draneaslaw.com.

Earlier this year, Portland, OR, residents Rick and Jackie White were stunned to find a very technically worded legal notice in their mail. A lien service company was informing them that a local towing company was auctioning off their 1970 ’Cuda to satisfy its unpaid storage bill.

They weren’t stunned because of the substantial unpaid bill. They were stunned because the Hemi ’Cuda had been stolen in 2001, and they had given up on ever finding it.

Rick White ordered the ’Cuda new in 1970 when he lived in California. It had a 440 Six Pack, 4-speed, 4.10 Dana rear end, bigger brakes — he ordered every option that would make it go fast. And it was a good looker — with dark metallic green paint with a silver shaker hood, black vinyl top and green interior.

After the thieves broke into his garage and rolled the ’Cuda away in 2001, all he had left to remember the all-original, numbers-matching car were some videos of the car racing on the Portland International Raceway drag strip. Now he was excited about getting it back.

They had contacted a towing service to pay the storage bill and get the car back. He was surprised to learn that the man who had stored the car, Lee Sitton, had just paid the bill and taken the car back. So he contacted Sitton, who claimed that he had purchased the car from someone else. It was his and he wasn’t giving it back.

White smelled a rat. He had the title, but Sitton claimed he bought the car fair and square from a third party but never received a title.

“No one buys a car without getting a title,” White insists. He also thinks that the lien foreclosure was a ruse to get Sitton a title for the car.

Earlier this year, Portland, OR, residents Rick and Jackie White were stunned to find a very technically worded legal notice in their mail. A lien service company was informing them that a local towing company was auctioning off their 1970 ’Cuda to satisfy its unpaid storage bill.

They weren’t stunned because of the substantial unpaid bill. They were stunned because the Hemi ’Cuda had been stolen in 2001, and they had given up on ever finding it.

Rick White ordered the ’Cuda new in 1970 when he lived in California. It had a 440 Six Pack, 4-speed, 4.10 Dana rear end, bigger brakes — he ordered every option that would make it go fast. And it was a good looker — with dark metallic green paint with a silver shaker hood, black vinyl top and green interior.

After the thieves broke into his garage and rolled the ’Cuda away in 2001, all he had left to remember the all-original, numbers-matching car were some videos of the car racing on the Portland International Raceway drag strip. Now he was excited about getting it back.

They had contacted a towing service to pay the storage bill and get the car back. He was surprised to learn that the man who had stored the car, Lee Sitton, had just paid the bill and taken the car back. So he contacted Sitton, who claimed that he had purchased the car from someone else. It was his and he wasn’t giving it back.

White smelled a rat. He had the title, but Sitton claimed he bought the car fair and square from a third party but never received a title.

“No one buys a car without getting a title,” White insists. He also thinks that the lien foreclosure was a ruse to get Sitton a title for the car.

Earlier this year, Portland, OR, residents Rick and Jackie White were stunned to find a very technically worded legal notice in their mail. A lien service company was informing them that a local towing company was auctioning off their 1970 ’Cuda to satisfy its unpaid storage bill.

They weren’t stunned because of the substantial unpaid bill. They were stunned because the Hemi ’Cuda had been stolen in 2001, and they had given up on ever finding it.

Rick White ordered the ’Cuda new in 1970 when he lived in California. It had a 440 Six Pack, 4-speed, 4.10 Dana rear end, bigger brakes — he ordered every option that would make it go fast. And it was a good looker — with dark metallic green paint with a silver shaker hood, black vinyl top and green interior.

After the thieves broke into his garage and rolled the ’Cuda away in 2001, all he had left to remember the all-original, numbers-matching car were some videos of the car racing on the Portland International Raceway drag strip. Now he was excited about getting it back.

They had contacted a towing service to pay the storage bill and get the car back. He was surprised to learn that the man who had stored the car, Lee Sitton, had just paid the bill and taken the car back. So he contacted Sitton, who claimed that he had purchased the car from someone else. It was his and he wasn’t giving it back.

White smelled a rat. He had the title, but Sitton claimed he bought the car fair and square from a third party but never received a title.

“No one buys a car without getting a title,” White insists. He also thinks that the lien foreclosure was a ruse to get Sitton a title for the car.

Earlier this year, Portland, OR, residents Rick and Jackie White were stunned to find a very technically worded legal notice in their mail. A lien service company was informing them that a local towing company was auctioning off their 1970 ’Cuda to satisfy its unpaid storage bill.

They weren’t stunned because of the substantial unpaid bill. They were stunned because the Hemi ’Cuda had been stolen in 2001, and they had given up on ever finding it.

Rick White ordered the ’Cuda new in 1970 when he lived in California. It had a 440 Six Pack, 4-speed, 4.10 Dana rear end, bigger brakes — he ordered every option that would make it go fast. And it was a good looker — with dark metallic green paint with a silver shaker hood, black vinyl top and green interior.

After the thieves broke into his garage and rolled the ’Cuda away in 2001, all he had left to remember the all-original, numbers-matching car were some videos of the car racing on the Portland International Raceway drag strip. Now he was excited about getting it back.

They had contacted a towing service to pay the storage bill and get the car back. He was surprised to learn that the man who had stored the car, Lee Sitton, had just paid the bill and taken the car back. So he contacted Sitton, who claimed that he had purchased the car from someone else. It was his and he wasn’t giving it back.

White smelled a rat. He had the title, but Sitton claimed he bought the car fair and square from a third party but never received a title.

“No one buys a car without getting a title,” White insists. He also thinks that the lien foreclosure was a ruse to get Sitton a title for the car.